Baltic Dry Index. 2366 -88

LIR Gold Target by 2019: $30,000. Revised.

“Let me put it simply: in this regard there may be a contradiction between the interests of the financial world and the interests of the political world. We cannot keep constantly explaining to our voters and our citizens why the taxpayer should bear the cost of certain risks and not those people who have earned a lot of money from taking those risks.”

Chancellor Merkel. 11 November 2010.

The leaders of the G-20 today, after 36 hours trapped in Seoul, South Korea, dining on Gaegogi which rhymes with doggy, grilled pork large intestines and Kimchi, locked in interminable discussions on what to discuss and whose fault it is that America’s gone broke again, plus why Irish bondholders should swap their bonds for Lehman CDOs, achieved a spectacular breakthrough late in the day, when crazed mediators from Britain, France, and Germany, persuaded the G-2 to call the whole thing off and go home. In an unexpected outbreak of comity, brotherly love and comedy, Presidents Obama and Hu quickly agreed to go home and blamed the whole impasse on the Irish and Greek governments for not living within their means and surrendering to German and French demands to slaughter their bondholders. No Irish or Greek representatives being present, this was deemed a good idea. While everyone bolted for the airport, President Obama remembered just how bad things are at home and headed off to visit Japan instead, one of the few industrialized G-20 nations with an outlook even worse than America’s. Cutoff from imports of Chinese rare earths and elements, the world may soon have to give up driving Toyota Priuses. Below, the Journal covers this small step for humanity, and giant leap for the G-20 leaders.

"In the long run, the gold price has to go up in relation to paper money. There is no other way.”

Nicholas L. Deak

NOVEMBER 12, 2010, 12:42 A.M. ET

G-20 to Fudge Differences

SEOUL—Leaders of the Group of 20 big countries were set Friday to gloss over key differences on curbing economic imbalances, highlighting how political squabbles have weighed on attempts to foster more stable global growth.

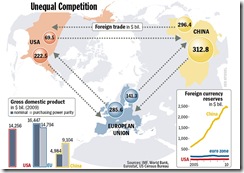

Issues such as external imbalances have dominated the two-day summit by the G-20, who are seeking to avert what has been dubbed a global "currency war," in which countries seek competitive advantage by weakening their currencies.

It appears that leaders were to some extent struggling to agree on how to define and quantify "indicative guidelines" meant to gauge progress, portending further tough political battles over reining in global imbalances.

"We don't want to tie imbalances to one indicator; there are a lot of factors that need to be included," German Chancellor Angela Merkel told reporters. "These factors need to be discussed, and finance ministers will do this exhaustively over the next year."

The G-20 leaders, in a communique ending the summit in Seoul, won't agree on targets or even a timetable for limiting external imbalances because they still haven't agreed on what is driving global imbalances and the role issues like currencies play, a U.K. official said.

----Political disagreement means the G-20's "Mutual Assessment Process" report will omit specific recommendations such as how fast China should let the yuan rise and how fast the U.S should cut its budget deficit, the people said.

The U.S. has pushed China to let the yuan rise more and for nonbinding targets to limit imbalances. China, in turn, has won adherents to its position that the Federal Reserve's lax U.S. monetary policy is weakening the dollar and pushing a wall of destabilizing speculative capital into emerging markets.

The summit aimed to build on a late-October meeting of G-20 finance ministers that produced an agreement to avoid "competitive devaluation" of currencies and to seek "sustainable" levels of imbalances, measured by a set of "indicative guidelines." The ministers rejected an informal U.S.-Korean proposal to target curbing imbalances to 4% of gross domestic product by 2015.

Friday's G-20 may fail to add much to the finance ministers' agreement because of disagreement between the likes of China and the U.S. over the basic facts of what is driving the imbalances, the U.K. official said. Instead, the leaders are likely to pledge to agree next year on an objective analysis behind the problem of global imbalances.

"Until you agree the problems, you won't be able to find solutions," the official said.

In theory, all get to do it all again at the next G-20 meeting next year. In the meantime, the IMF is supposed to study the currency wars and suggest a solution. Stay long precious metals. After this G-20 meeting, nothing has changed. America is still living far beyond its means and setting out to trash its currency in the expectation this will somehow reduce unemployment. Europe is still heading towards a Club Med vs the rest, Euro split. China is still racking up a massive dollar surplus and still has a domestic property bubble that could burst at any time. Japan is aging its way towards a domestic crisis.

In other Asian news, China’s latest 5 year plan is intended to convert China from manufacturer to the world into consumer of the world. Were it to happen and 1.3 billion people start consuming like Americans all on credit, we are heading for the boom of all booms, and then a , massive credit bust. Happily it’s unlikely to happen. The world would quickly price scarce limited basic resources too high for the transition to occur. Even so, China has served notice that we are in for a decade of change ahead, starting in the next 5 years. Another reason to stay with precious metals.

One message is clear: The Chinese government wants to foster a national transformation from "world's factory" to "world's market."

11.09.2010 17:14

Get Ready for China's Big Development Switch

The latest five-year plan exposes tension between old and new growth models, but change cannot be stopped

China's recently released a draft plan for the next five years is nothing short of full-blown strategy for transforming the nation's development model. In a first for the government's planning process, the 12th Five-Year Plan for the 2011-2015 period outlines specific steps designed to raise consumption levels and make China a leading consumer market.

One message is clear: The Chinese government wants to foster a national transformation from "world's factory" to "world's market."

Can China effectively change its development model? The answer will determine whether the nation can indeed rise to the top among global consumer markets and, indeed, whether the next five-year plan works.

China cannot afford to delay the scheduled change from an "extensive" resource- and export-driven growth model to an "intensive" model that's driven by technological advancement and efficiency.

----Export-oriented trades have created tens of millions of jobs and earned China the title "world's factory." But the country has paid a heavy price for this fame in the form of worsening "hidden" inflation, labor disputes, environmental degradation and international trade conflicts. And although this model of development is clearly unsustainable and on its last legs, some argue that it should continue contributing to the economy.

In fact, conflict between old and new models has led to problematic tension in the economy and society.

To move forward, the latest five-year plan stresses the strategic importance of economic transformation. Economic observers at home and abroad say the government is serious this time about taking action. Decision-makers are said to have finally reached a consensus on the need for strategic change. They've been influenced by the global financial crisis, which irrevocably changed the external environment's role in the mainland economy, forcing China to turn inward in search of alternative product demand.

In other words, the real challenge since the crisis has been to find new ways to drive economic growth. The financial meltdown drove this search for new growth models, and now conditions in China are ripe for the change already under way.

More

http://english.caing.com/2010-11-09/100197196.html

"Gold would have value if for no other reason than that it enables a citizen to fashion his financial escape from the state."

William F. Rickenbacker

At the Comex silver depositories Thursday, final figures were: Registered 50.54 Moz, Eligible 57.25 Moz, Total 107.79 Moz.

+++++

Crooks and Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

Today, more on the unfolding Euro crisis. Will Ireland cave in at the weekend and ask for a bailout? Will this weekend bring another Bear Stearns or Lehman moment?

The Irish Times has established, however, that informal contacts are under way between Brussels, Berlin and other capitals to assess their readiness to activate the €750 billion rescue fund in the event of an application from Dublin.

Germany blamed for Irish debt soar

Ireland pointed the finger at Germany for stoking fears that holders of government bonds could be forced to suffer losses as the cost of Ireland's borrowing hit fresh highs.

9:14PM GMT 11 Nov 2010

Concerns Ireland will require an International Monetary Fund-EU bail-out helped push yields on 10-year Irish Government bonds up to around 9pc, a record, as investors demanded higher returns to shoulder the risk.

Markets worry whether Ireland will be able to pay its debts, given its costly bank bail-out, weak growth and a huge budget deficit of 14.4pc of GDP, the eurozone's highest.

British taxpayers took a hit as shares in Royal Bank of Scotland fell 2.7pc to 41.02p on fears over the state-backed bank's exposure to the Irish market through an estimated £50bn of loans. One source said some traders were using the bank as a proxy to short Ireland.

Brian Lenihan, Ireland's finance minister said the spike in borrowing costs was partly driven by "unintended" German comments proposing bondholders be forced to take losses or "haircuts" if sovereign debt is restructured.

The market nerves pushed the spread between Irish 10-year bond yields and German yields to well over 6 percentage points, a new record. The cost of insuring Irish debt against default also hit a fresh high.

"The bond spreads are very serious and there is international concern throughout the eurozone about that," said Mr Lenihan, adding he would look for clarification of the German plans. He also tried to reassure that comments from Ireland's central bank governor – that IMF austerity plans for Ireland would not differ greatly from Dublin's – were not laying the ground for aid.

Germany has indicated the proposals would not apply to existing debt, but fears over potential losses are high after France said on Wednesday that investors must share in the cost of safeguarding debt.

German Chancellor Angela Merkel argued on Thursday that taxpayers could not keep being told they "have to be on the hook for certain risks, rather than those who make a lot of money taking those risks."

Although the Irish government is fully funded into the middle of next year, analysts warned politicians' talk of haircuts risked creating a self-fulfilling prophecy that Ireland and other debt-laden nations will have to restructure.

-----"The most likely outcome now is that Ireland will need to receive assistance from the EU/IMF," said Gary Jenkins at Evolution, who estimated a funding requirement of around €43bn over two years.

Attempts from the European Commission to reassure for a second day running that Ireland has not requested any assistance from Europe did little to placate investors, after Commission president Jose Manuel Barroso said it was ready to "act if necessary".

There were warnings solvency fears were spreading as Portugal and Spain also saw the cost of insuring their debt against default soar, which kept the euro under continued pressure, hitting a five-week low under $1.37.

http://www.telegraph.co.uk/finance/economics/8127612/Germany-blamed-for-Irish-debt-soar.html

NOVEMBER 12, 2010

Europe Running out of Yellow Cards on the Debt Crisis

If history marks this week as the start of Europe's Debt Crisis II, next week has promise for still more nerve-testing action along Europe's crumbling outer rim.

Fiscally frail Ireland and Portugal will stay caught in the spotlight of unforgiving bond investors. Joining them on Monday will be Greece, no stranger to that script.

Officials from the European Union and the International Monetary Fund descend on Athens next week for their newest look into the Greek treasury's books and will decide whether Greece has earned its next payment tranche. On Thursday, Greece is expected to present its final 2011 budget to parliament and with it its latest budget estimates.

The rough picture already emerges that the Greek government underestimated the severity of its crackdown on spending to comply with EU and IMF rules. Stiff austerity cuts, overestimated tax receipts and recurrent strikes by alternating segments of the work force have taken their toll on the economy and now numbers are off course.

If history marks this week as the start of Europe's Debt Crisis II, next week has promise for still more nerve-testing action along Europe's crumbling outer rim.

Fiscally frail Ireland and Portugal will stay caught in the spotlight of unforgiving bond investors. Joining them on Monday will be Greece, no stranger to that script.

Officials from the European Union and the International Monetary Fund descend on Athens next week for their newest look into the Greek treasury's books and will decide whether Greece has earned its next payment tranche. On Thursday, Greece is expected to present its final 2011 budget to parliament and with it its latest budget estimates.

The rough picture already emerges that the Greek government underestimated the severity of its crackdown on spending to comply with EU and IMF rules. Stiff austerity cuts, overestimated tax receipts and recurrent strikes by alternating segments of the work force have taken their toll on the economy and now numbers are off course.

More.

Friday, November 12, 2010

Merkel refuses to back down over debt burden

------Amid a loss of market confidence in Ireland, political anxiety in Europe centres on the fragility of the Government’s position as it prepares to extract €6 billion in cutbacks and tax increases in the budget and a total of €15 billion in the four-year recovery plan. Further concern surrounds the position of Ireland’s banks, whose shares have fallen steadily in recent days amid fears the €45 billion bailout bill might rise.

Although some diplomats say it is to Ireland’s advantage that the Government is not at present borrowing from the investors, fear of contagion emerged again yesterday as the premium on Spanish and Italian debt jumped to record levels.

With the single currency falling to a one-month low against the dollar, euro-zone finance ministers will discuss Ireland’s position at their monthly meeting next Tuesday in Brussels. As 10-year borrowing costs reached 9.26 per cent yesterday, Ireland is seen to be at the centre of renewed market turbulence. “What is important to know is that we have all the essential instruments in place in the EU and euro zone to act if necessary,” Mr Barroso said.

In Brussels, a commission spokesman said the European authorities are following the situation very closely. “There is no request for the moment. There is no need to activate any mechanism, Mr Barroso just confirmed that, in case of need, the mechanisms are in place,” he said.

http://www.irishtimes.com/newspaper/frontpage/2010/1112/1224283151994.html

“The fate of the nation and the fate of the currency are one and the same."

Dr. Franz Pick

Another weekend, and our season of gales and storms has arrived, and not just in the weather either. The past week brought the first austerity riot to Great Britain, and hardly anyone has been hit with austerity yet. Stay long precious metals. There a whole lot more storms coming, I think, and not just on the right side of the Atlantic. The Baltic Dry Index implies global trade is dipping again, even as the great commodity super cycle has started another leg up. Time to preserve cash and reduce risk, I think. Time to prepare for God’s northern hemisphere winter wonderland, even as austerity bites. Next week, the Eurozone will be forced to confront its inconvenient truth. Next week, even a travelling US President gets to go home. Have a great weekend everyone.

"When paper money systems begin to crack at the seams, the run to gold could be explosive."

Harry Browne

The monthly Coppock Indicators finished October:

DJIA: +204 Down. NASDAQ: +289 Down. SP500: +196 Down.

The bull market (or bear market rally) that commenced on Nasdaq on 30/4/09 at 1717 has ended. (30/5/09 SP 500 at 919, 30/5/09 DJIA 8500.) While the indicators can flip flop at market turns, this action is rare on the slow monthly indicators. October is the fifth down month in a row.