Baltic Dry Index. 2569 +91

LIR Gold Target by 2019: $3,000.

"The history of fiat money is little more than a register of monetary follies and inflations. Our present age merely affords another entry in this dismal register."

Hans F. Sennholz

It’s time to buy tangible assets, think the world’s managers of smart money, as Japan kicks off a new race to the bottom in fiat currency devaluation. Below, the scandal tainted Frenchman running the IMF attempts to shut the stable door long after the horses have bolted. The Great Nixonian Error of fiat currency is deep into its final act of tragedy. But don’t tell anyone in the stock markets, where all news is now only good news. Time to swap yet more pictures of dead US white men for something real.

"Gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium."

Murray N. Rothbard

IMF chief fears risk of currency war after Japan's zero interest rate move

The Bank of Japan’s surprise move to reinstate zero interest rates has led to a warning of the danger of a currency war from the head of the International Monetary Fund.

By Philip Aldrick and Jonathan Russell Published: 11:34PM BST 05 Oct 2010

Dominique Strauss-Kahn warned that moves by central banks across the world to cut interest rates and carry out billions of pounds worth of quantitative easing could upset the global economy recovery as currencies chased each other ever lower.

In an interview with the Financial Times, he said: “There is clearly the idea beginning to circulate that currencies can be used as a policy weapon. Translated into action, such an idea would represent a very serious risk to the global recovery ... Any such approach would have a negative and very damaging longer-run impact.”

Japan surprised markets by adopting a zero interest rate policy and announcing plans for quantitative easing (QE) in an attempt to inject fresh stimulus into the economy.

The move led to an immediate fall in the value of the yen against the dollar.

The Japanese central bank has pledged to buy assets worth five trillion yen (£38bn) and cut its overnight rate to between zero and 0.1pc,from 0.1pc, reinstating the so-called “zero interest policy” that the Bank only ended in July 2006.

It will keep its benchmark rate effectively at zero until establishing price stability, adopting a similar loose policy commitment to the US Federal Reserve.

The size of the QE programme roughly matches the extra stimulus package desired by the Japanese government. Japan is running out of options as it seeks to reinvigorate its economy in the face of national debt running at twice the national output – the largest of the advanced economies.

-----Japan is not the only country enact policies that could suppress the value of its currency. Brazil recently threatened to intervene to keep the real down and earlier this week doubled taxes on foreign investors buying Brazilian bonds. The move was seen as way of stopping large inflows of foreign currency pushing up the value of the real.

Mr Strauss-Kahn was speaking ahead of this week’s IMF and World Bank annual meeting.

Today we leave the last word on the fiat currency war to the hard working, tax paying Germans, new owners of the land formerly known as Greece. Will Germanic habits invade Greece, or Greek habits invade Germany?

"With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people."

F.A. von Hayek

World Faces New Wave of Currency Wars

The Specter of Protectionism 10/05/2010

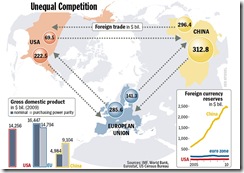

An American bill imposing punitive tarifs on countries that undervalue their currencies is set to unleash a new trade war between the US and China. But in fact the whole global currency system is in a state of jeopardy. As confidence in the dollar drops, private investors are putting their faith in gold. By SPIEGEL Staff.

At first glance, the new bill sounds perfectly innocuous. "H. R. 2378 -- Currency Reform for Fair Trade Act" was on the agenda of the US House of Representatives late last Wednesday afternoon. Fair trade -- who could object to that?

But as the representatives started debating, it didn't sound harmless anymore. In fact, it sounded like war.

"International trade is a high-stakes, cutthroat business. And every time we simply talk, the other side acts. And every time they act, an American loses a job," said Xavier Becerra, a Democratic congressman from California.

Timothy Murphy, a Republican from Pennsylvania, went one step further: "We are about to lose our position as a global leader when next year China overtakes us as the biggest manufacturer in the world. The trouble is that China has never really accepted the basic rules of fair trade."

Democrat Linda Sanchez from California argued: "Opponents say that this bill will start a trade war. I say, we are already in a trade war. And China is using cannons and we're standing here shooting (air gun) pellets."

More.

http://www.spiegel.de/international/world/0,1518,721044,00.html#ref=nlint

Banks' $4 trillion debts are 'Achilles’ heel of the economic recovery', warns IMF

More taxpayer support is needed to ensure global financial stability despite the billions already pledged, the International Monetary Fund has warned, as banks remain the “achilles heel” of the economic recovery.

By Philip Aldrick, Economics Editor Published: 2:27PM BST 05 Oct 2010

Lenders across Europe and the US are facing a $4 trillion refinancing hurdle in the coming 24 months and many still need to recapitalise, the Washington-based organisation said in its Global Financial Stability Report. Governments will have to inject fresh equity into banks – particularly in Spain, Germany and the US – as well as prop up their funding structures by extending emergency support.

“Progress toward global financial stability has experienced a setback since April ... [due to] the recent turmoil in sovereign debt markets,” the IMF said. “The global financial system is still in a period of significant uncertainty and remains the Achilles’ heel of the economic recovery.”

Although banks have recognised all but $550bn of the $2.2 trillion of bad debts the IMF estimates needed to be written off between 2007 and 2010, they are still facing a looming funding shock that will need state support. “Nearly $4 trillion of bank debt will need to be rolled over in the next 24 months,” the report says.

“Planned exit strategies from unconventional monetary and financial support may need to be delayed until the situation is more robust, especially in Europe... With the situation still fragile, some of the public support that has been given to banks in recent years will have to be continued.”

Although the IMF does not mention individual countries, it is clear it has concerns about the UK. According to the Bank of England, British banks need to refinance £750bn-£800bn of funding by the end of 2012, £285bn of which is emergency support that expires in the same period.

The IMF adds: “Without further bolstering of balance sheets, banking systems remain susceptible to funding shocks that could intensify deleveraging pressures and place a further drag on public finances and the recovery.”

Elsewhere, smart money is moving itself into tangible assets of long term value. Why hold dodgy fiat currency if everyone and their dog is going to trash fiat currency in a futile effort to beggar their neighbor. Stay long precious metals. Gold has remonitised itself no matter what the central banksters think.

"As fewer and fewer people have confidence in paper as a store of value, the price of gold will continue to rise."

Jerome F. Smith

Gold futures climb near $1,350 on Globex

Oct. 6, 2010, 1:18 a.m. EDT

TOKYO (MarketWatch) — Gold futures extended their record streak onto Globex during Asia’s Wednesday afternoon trading, with the Bank of Japan’s surprise cut in interest rates and further weakness in the U.S. dollar helping to lift prices for the precious metal to nearly $1,350 an ounce.

http://www.marketwatch.com/story/gold-futures-climb-above-1345-on-globex-2010-10-05

Copper hits 26-month high, but rally could stall

Long-term prospects for metal are bullish, but first, a correction?

SAN FRANCISCO (MarketWatch) -- Copper soared to a 26-month high on Tuesday, adding to a longer-term rally on the back of a weaker dollar that has made investing in commodities more appealing. But the metal could get a reality check in just a few days.

Analysts are quick to point out the fundamentals of the copper market bode well for sustained high prices. Supply has stalled, with very few new mines coming on line in a sector rife with labor disputes. There is enough demand from China alone to support strong prices for copper.

-----Copper rose 8.3% in September, following gains of 1.5% in August and 12% in July. So far this year, the metal has gained 11%, earning it a sure spot among 2010’s most lucrative investments.

Moreover, copper is generally seen as a harbinger of economic activity. The metal is sometimes called Dr. Copper — a nickname earned for its ability to run ahead of booms and busts because of its widespread use in building, manufacturing and electronics.

And at least one major investment bank thinks the rally has plenty of legs. Goldman Sachs, also a major commodities broker, on Tuesday increased its price targets for copper, making a case for long-term higher prices on supply constraints and hopes demand will pick up.

-----“Even relatively conservative demand forecasts suggest that the global copper market will sustain deficits large enough to mostly deplete exchange inventories over the next five quarters, leading to periods of extreme volatility and price spikes,” the Goldman analysts said.

They raised their price forecasts well past $8,000 per metric ton in the next three and six months, and pegged copper at $11,000 a metric ton in 12 months, or $5 a pound.

http://www.marketwatch.com/story/copper-extends-rise-but-short-term-dip-may-be-due-2010-10-05

Oil rallies to a five-month high

Traders will get their first look at inventories Tuesday afternoon

Oct. 5, 2010, 3:36 p.m. EDT

SAN FRANCISCO (MarketWatch) — Crude futures rose to a five-month high Tuesday, helped by a weaker U.S. dollar, bullish moves in global equities and hopes that the U.S. will soon follow Japan’s footsteps in expanding liquidity measures.

----Gasoline finished at a two-month high.

A surprise interest-rate cut in Japan helped set the tone, with the nation’s central bank pledging to buy assets while setting its key interest rate between zero and 0.1%.

A similar round of moves giving rise to currency devaluations in the U.S. and around the world — as well as tightening oil-market fundamentals — are likely to push prices even higher, analysts at J.P. Morgan wrote in a note Tuesday.

http://www.marketwatch.com/story/crude-resumes-gains-nears-82-a-barrel-2010-10-05

In food and weather news, bad news from the southern hemisphere where winter has turned into spring, and brought the worst late winter blizzard “in living memory”. New Zealand is a major supplier of lamb to the world and it is only a matter of time before the price of lamb will rise to reflect reduced supply.

NZ - Snow hits farmers big time

05 Oct 2010

Following a reasonably benign winter, the Southland region of New Zealand (NZ) has in the past week been hit by “the worst spring storm in living memory” according to the NZ Herald.

Six days of blizzards have caused deaths among new lambs numbering in the hundreds of thousands, and raised concern over the welfare of ewes yet to lamb.

Besides the effect of the cold weather itself, the continued snowfall has not allowed snow on the ground to thaw, making it much harder for stock to feed.

This makes ewes about to lamb particularly susceptible to metabolic illnesses from a lack of nutrients.

Reportedly, lamb mortality in the area may be as high as 15% for some farmers.

http://www.meattradenewsdaily.co.uk/news/051010/nz___snow_hits_farmers_big_time_.aspx

Bad news too for those of us fearing the arrival of global cooling. Is another hard back to back winter about to hit in the northern hemisphere?

Coldest winter in 1,000 years on its way

04 October, 2010, 22:20

After the record heat wave this summer, Russia's weather seems to have acquired a taste for the extreme.

Forecasters say this winter could be the coldest Europe has seen in the last 1,000 years.

The change is reportedly connected with the speed of the Gulf Stream, which has shrunk in half in just the last couple of years. Polish scientists say that it means the stream will not be able to compensate for the cold from the Arctic winds. According to them, when the stream is completely stopped, a new Ice Age will begin in Europe.Read more

So far, the results have been lower temperatures: for example, in Central Russia, they are a couple of degrees below the norm.

“Although the forecast for the next month is only 70 percent accurate, I find the cold winter scenario quite likely,” Vadim Zavodchenkov, a leading specialist at the Fobos weather center, told RT. “We will be able to judge with more certainty come November. As for last summer's heat, the statistical models that meteorologists use to draw up long-term forecasts aren't able to predict an anomaly like that.”

http://rt.com/prime-time/2010-10-04/coldest-winter-emergency-measures.html/print

"For more than two thousand years gold's natural qualities made it man's universal medium of exchange. In contrast to political money, gold is honest money that survived the ages and will live on long after the political fiats of today have gone the way of all paper."

Hans F. Sennholz

At the Comex silver depositories Tuesday, final figures were: Registered 52.26 Moz, Eligible 58.79 Moz, Total 111.05 Moz.

+++++

Crooks and Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

No crooks or scoundrels today, at least not in the ordinary use of those words. Today, the latest news from the USA on renewable energy. The timing has all to do with getting access to expiring federal grants and loan guarantees for renewable energy. Still, the solar plants if built, will advance the solar technology database and as with all new technologies as they get adopted, will likely lead to big advances in solar power efficiency in the decade ahead. California today, America tomorrow, the rest of the world that day after. Well maybe not quite, but with a world heading towards a population of 9 billion by mid century, renewable energy has to be a part of meeting our future energy needs.

Solar Power Plants to Rise on U.S. Land

By FELICITY BARRINGER Published: October 5, 2010

SAN FRANCISCO — Proposals for the first large solar power plants ever built on federal lands won final approval on Tuesday from Interior Secretary Ken Salazar, reflecting the Obama administration’s resolve to promote renewable energy in the face of Congressional inaction.

Both plants are to rise in the California desert under a fast-track program that dovetails with the state’s own aggressive effort to push development of solar, wind and geothermal power. The far larger one, a 709-megawatt project proposed by Tessera Solar on 6,360 acres in the Imperial Valley, will use “Suncatchers” — reflectors in the shape of radar dishes — to concentrate solar energy and activate a four-cylinder engine to generate electricity.

A 45-megawatt system proposed by Chevron Energy Solutions and featuring arrays of up to 40,500 solar panels will be built on 422 acres of the Lucerne Valley. When complete, the two projects could generate enough energy to power as many as 566,000 homes.

Mr. Salazar is expected to sign off on perhaps five more projects this year; the combined long-term output of all the plants would be four times that of the first two.

“It’s our expectation we will see thousands of megawatts of solar energy sprouting on public lands,” he told reporters.

The announcement, which came shortly after the White House unveiled plans to install the latest generation of solar panels on the roof of its living quarters, reflects a need to enable solar manufacturers to break ground by the end of 2010 so they can share in soon-to-expire grants and loan guarantees for renewable energy.

Federal stimulus grants and federal loan guarantees could underwrite as much as hundreds of millions of dollars or more of the $2.1 billion Imperial Valley plant, said Janette Coates, a Tessera spokeswoman.

The decision also follows a long series of setbacks for climate and energy legislation in Congress. After passage of a House bill last year, efforts to advance a major emissions-reducing bill through the Senate collapsed over the summer for lack of votes linked to fears of a voter backlash.

In addition to the two plants approved Tuesday, projects that are poised to gain approval by the end of the year include BrightSource Energy’s proposed 370-megawatt Ivanpah facility, Tessera’s 850-megawatt Calico project, NextEra’s 250-megawatt Genesis Solar Energy Plant and Solar Millennium’s 1,000-megawatt Blythe project.

The next batch of approvals, Secretary Salazar said, “is something that is not months away.”

http://www.nytimes.com/2010/10/06/science/earth/06solar.html?hp

"When paper money systems begin to crack at the seams, the run to gold could be explosive."

Harry Browne

The monthly Coppock Indicators finished September:

DJIA: +227 Down. NASDAQ: +321 Down. SP500: +221 Down.

The bull market (or bear market rally) that commenced on Nasdaq on 30/4/09 at 1717 has ended. (30/5/09 SP 500 at 919, 30/5/09 DJIA 8500.) While the indicators can flip flop at market turns, this action is rare on the slow monthly indicators. September is the fourth down month in a row.

No comments:

Post a Comment