Baltic Dry Index. 2695 -01

LIR Gold Target by 2019: $3,000.

There is about $14.2 trillion in total U.S. mortgage debt outstanding. There are about $8.9 trillion in total U.S. mortgage-related securities. The volume of pooled mortgages stands at about $7.5 trillion. About $5 trillion of that is securitized or guaranteed by government sponsored enterprises (GSEs) or government agencies, the remaining $2.5 trillion pooled by private mortgage conduits. Mortgage backed securities can be considered to have been in the tens of trillions, if Credit Default Swaps are taken into account.

Today, only one story is worth following.

Welcome to MERS! [Est.1995]

MERS

1818 Library Street, Suite 300Reston, VA 20190

MERS is an innovative process that simplifies the way mortgage ownership and servicing rights are originated, sold and tracked. Created by the real estate finance industry, MERS eliminates the need to prepare and record assignments when trading residential and commercial mortgage loans.

MERS was created by the mortgage banking industry to streamline the mortgage process by using electronic commerce to eliminate paper. Our mission is to register every mortgage loan in the United States on the MERS® System.

Beneficiaries of MERS include mortgage originators, servicers, warehouse lenders, wholesale lenders, retail lenders, document custodians, settlement agents, title companies, insurers, investors, county recorders and consumers.

MERS acts as nominee in the county land records for the lender and servicer. Any loan registered on the MERS® System is inoculated against future assignments because MERS remains the nominal mortgagee no matter how many times servicing is traded. MERS as original mortgagee (MOM) is approved by Fannie Mae, Freddie Mac, Ginnie Mae, FHA and VA, California and Utah Housing Finance Agencies, as well as all of the major Wall Street rating agencies.

RESTON TOWN CENTER1818 Library Street, Suite 500Reston, VA 20190

Virtual Office Features:

https://www.davincivirtual.com/loc/us/virginia/reston-virtual-offices/facility-848

October 2010 will go down in history as the month the world’s biggest ever fraud came to light. The story surfaced at the end of the previous month but it was only in October the scale and sheer brazenness of the Wall Street fraud came to light. Even now its full extent and implications aren’t realized and many on Wall Street and in the media still don’t get it. They think it’s a case of the banks just getting the paperwork wrong on a few deadbeat homeowners. Homeowners deserving of contempt and opprobrium for failing to pay on their mortgages. In a few extreme cases, according to the media, some bad apples may have forged the odd signature or two, a couple of notaries may have falsely attested to have witnessed signatures when they didn’t. So what. There’s no disputing that these people are dead beats after all, cheats preying on society. But that only tells a tiny fraction of the story.

Your closing process is even easier if the old mortgage on the property was registered on MERS, because the lien release process is not delayed because of missing or incorrect prior assignments. Chain of title starts and stops with MERS!

Thanks to MERs, a virtual company with no employees, some 60 million residential US real estate titles are now clouded, with some large part of that figure fraudulent. Nobody yet knows which are good, which are merely deficient but correctable, and which were the product of transfer fraud. No one yet knows who, if anyone, owns what once the mortgages were improperly securitized thanks to MERS. Since the whole purpose behind setting up MERS by Wall Street was to speed up the securitisation of residential mortgages, these 60 million mortgages have been sliced and diced into billions of pools of securities and peddled around the world to unsuspecting mugs who thought they were dealing with upright people. Little did they realize that they were dealing the sleazy heirs to Madoff, although that does a disservice to convicted fraudster Madoff. He never set out to con the world, people came to him largely trying to force money upon him to trade.

Now Goldman Sachs Is Freezing Foreclosures

Published: Monday, 11 Oct 2010 4:47 PM ET

http://www.cnbc.com/id/39619909

In the world’s greatest fraud of all time, the Wall Street banksters deliberately set out to short circuit the US real estate system, all to save on filing fees (county taxes) and all, at the end of the day, to pay themselves outrageously high bonuses earned on the sale of fraudulent RMBS, CDOs, CDOs cubed, and CDS, and then to get that money out of the system ASAP before it’s inevitable collapse. Mens Re, with malice aforethought.

MERS saves time associated with processing multiple assignments. MERS also streamlines the lien release process since MERS is virtually guaranteed to be the end of the chain of title. This corresponds to reduced research time and fewer re-recording fees.

FDN attorneys Jeff Barnes, Esq. and Elizabeth Lemoine, Esq. have achieved a significant victory in Federal Court in Oregon against MERS. On Tuesday, September 28, 2010, Mr. Barnes and Ms. Lemoine defended and argued Motions to Dismiss the borrowers’ lawsuit challenging a nonjudicial foreclosure. The Motions were filed by the Defendants OneWest Bank and MERS. The action was originally filed in state court where a temporary restraining order was entered stopping the sale. On the eve of the scheduled hearing on the borrowers’ Motion for Preliminary Injunction, Defendants OneWest Bank, MERS, and Regional Trustee Services removed the case to Federal Court in an obvious attempt to circumvent the state court injunction hearing. The Federal Court entered an Injunction and scheduled a hearing on the Motions filed by the Defendants.

During the course of the hearing, the Court repeatedly raised the “MERS as nominee” issues to counsel for the Defendants, with said counsel finally admitting, upon repeated inquiry by the Court, that MERS cannot transfer promissory notes. The Court denied the Motions to Dismiss and has, by Order, commanded the injunction against the sale to remain in place through the duration of the borrowers’ lawsuit.

The questions posed to the Defendants’ counsel by the Court on the record demonstrate, again (as with the concerns of the Michigan court highlighted in our other post today), that courts are really starting to examine the inconsistent claims made by MERS (e.g. that it is “solely a nominee” yet purports to have authority to further foreclosures by, among other things, transferring promissory notes and appointing successor trustees). What the case law is consistently holding is that MERS cannot do what it has purported to do (and has done in what appears to be over sixty (60) million mortgage transactions nationally).

http://en.wikipedia.org/wiki/MERS

After ongoing INVESTIGATIONS: Lender Processing Services (LPS) closed the offices of its subsidiary, Docx, LLC, in Alpharetta, Georgia

On April 12, 2010, Lender Processing Services closed the offices of its subsidiary, Docx, LLC, in Alpharetta, Georgia. That office was responsible for pumping out over a million mortgage assignments in the last two years so that banks could foreclose on residential real estate. The law firms handling the foreclosures were retained and largely controlled by Lender Processing Services, according to a Sanctions Order entered by U.S. Bankruptcy Judge Diane Weiss Sigmund (In re Niles C. Taylor, EDPA, Case 07-15385-sr, Doc. 193). Lender Processing Services, the largest “default management services company” in the country, has already made at least partial admissions that there were faults in the documents produced by the Docx office – although courts and homeowners were never notified. According to Lender Processing Services, over 50 major banks use their default management services.

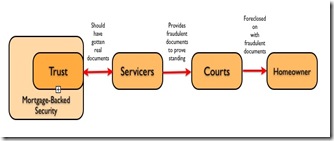

The banks that especially need the services provided by Lender Processing Services include Deutsche Bank, Citibank, Wells Fargo and U.S. Bank, acting as trustees for mortgage-backed securitized trusts. These trusts, in the rush to securitize mortgages and sell them to investors, often ignored the critical step of obtaining mortgage assignments from the original lenders to the securities companies to the trusts. Now, years later, when the companies “servicing” the trusts need to foreclose, they retain Lender Processing Services to draft the missing documents. The mortgage servicers, including American Home Mortgage Services, Saxon Mortgage Services, and American Servicing Company, never disclose that the trusts are missing essential documents – they just rely on Lender Processing Services to “fix” the problems.

More.

http://rortybomb.files.wordpress.com/2010/10/foreclose_101.jpgss.com/2010/10/foreclose_101.jpg

Deal or no deal. We end for the day with one of the minor consequences of the MERS muck-up. Wait until the senior note holders find out that their box is empty and that the banker wins again.

Moody's see higher losses for RMBS senior noteholders from foreclosure halts

Monday, October 11th, 2010, 4:15 pm

Moody's Investors Service expects senior noteholders of residential mortgage-backed securities will see increased losses because of escalating servicing costs caused by the halt in foreclosures, and the "prolonged use of mortgage-interest cash flow to pay interest on subordinate notes rather than pay principal on senior notes."

Analysts said foreclosure and property liquidation timelines will continue to increase as some the nation's largest mortgage lenders halt the foreclosure process altogether to review procedures.

---- The ratings agency conducted analysis of a single, subprime mortgage by extending the foreclosure process by 18 months and found the delay could boost loss severity by 10% or more due to increased costs.

Stay long precious metals.

A bank is a confidence trick. If you put up the right signs, the wizards of finance themselves will come in and ask you to take their money.

Jules Bertillon. A House of All Nations. 1938. Christina Stead.

At the Comex silver depositories Tuesday, final figures were: Registered 52.27 Moz, Eligible 60.28 Moz, Total 112.55 Moz.

+++++

Crooks and Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

Today more on the mortgage scam on the unsuspecting world by the US banksters. Below must read articles on the outrageous fraud on the US financial system by banksters just forging missing or deliberately destroyed documents. A fraud that seems to also involve defrauding the IRS and thus US taxpayers. This time round, unlike the banksters at Swiss giant UBS, the banksters are American and have nowhere to hide from Uncle Sam. It looks like convicted fraudster Madoff will soon be getting a much higher class of fraudster to keep him company for the next 150 years.

The reason “many firms file lost note counts as a standard alternative pleading in the [foreclosure] complaint” is because the physical document was deliberately eliminated to avoid confusion immediately upon its conversion to an electronic file.

Florida Bankers Association.

Foreclosure Fraud For Dummies, 2: What is a Note, and Why is it So Important?

(This is a series giving a basic explanation of the current foreclosure fraud crisis: Here is Part One. This is Part Two, Part Three, and Part Four.)

The SEIU has a campaign: Where’s the Note? Demand to see your mortgage note. It’s worth checking out. But first, what is this note? And why would its existence be important to struggling homeowners, homeowners in foreclosure, and investors in mortgage backed securities?

There’s going to be a campaign to convince you that having the note correctly filed and produced isn’t that important (see, to start, this WSJ editorial from the weekend). This is like some sort of useless cover sheet for a TPS form that someone forgot to fill out. That is profoundly incorrect.

Independent of the fraud that was committed on our courts, the current crisis is important because the note is a crucial document for every party to a mortgage. But first, let’s define what a mortgage is. A mortgage consists of two documents, a note and a lien:

More.

Sunday, October 3, 2010

4ClosureFraud Posts Lender Processing Services Mortgage Document Fabrication Price Sheet

A bombshell has dropped in mortgage land.

We’ve said for some time that document fabrication is widespread in foreclosures. The reason is that the note, which is the borrower IOU, is the critical instrument to establishing the right to foreclose in 45 states (in those states, the mortgage, which is the lien on the property, is a mere “accessory” to the note).

The pooling and servicing agreement, which governs the creation of mortgage backed securities, called for the note to be endorsed (wet ink signatures) through the full chain of title. That means that the originator had to sign the note over to an intermediary party (there were usually at least two), who’d then have to endorse it over to the next intermediary party, and the final intermediary would have to endorse it over to the trustee on behalf of a specified trust (the entity that holds all the notes). This had to be done by closing; there were limited exceptions up to 90 days out; after that, no tickie, no laundry.

Evidence is mounting that for cost reasons, starting in the 2004-2005 time frame, originators like Countrywide simply quit conveying the note. We are told this practice was widespread, probably endemic. The notes are apparently are still in originator warehouses. That means the trust does not have them (the legalese is it is not the real party of interest), therefore it is not in a position to foreclose on behalf of the RMBS investors. So various ruses have been used to finesse this rather large problem.

----- We finally have concrete proof of how widespread document fabrication was.

More

EXCLUSIVE ‘MERS’ DEPOSITION of SECRETARY and TREASURER of MERSCORP 4/2010

Does MERS have any salaried employees?A No.

Q Does MERS have any employees?A Did they ever have any? I couldn’t hear you.

Q Does MERS have any employees currently?A No.

Q In the last five years has MERS had anyemployees?A No.

Q So you are the secretary of MERS, but are notan employee of MERS?

A That’s correct.

etc

…How many assistant secretaries have youappointed pursuant to the April 9, 1998 resolution; howmany assistant secretaries of MERS have you appointed?

A I don’t know that number.

Q Approximately?A I wouldn’t even begin to be able to tell youright now.

Q Is it in the thousands?A Yes.

Q Have you been doing this all around thecountry in every state in the country? A Yes.

Q And all these officers I understand are unpaidofficers of MERS?A Yes.

Q And there’s no live person who is an employeeof MERS that they report to, is that correct, who is anemployee?MR. BROCHIN: Object to the form of thequestion.

A There are no employees of MERS.

"It's strange that men should take up crime when there are so many legal ways to be dishonest. “

Al Capone

The monthly Coppock Indicators finished September:

DJIA: +227 Down. NASDAQ: +321 Down. SP500: +221 Down.

The bull market (or bear market rally) that commenced on Nasdaq on 30/4/09 at 1717 has ended. (30/5/09 SP 500 at 919, 30/5/09 DJIA 8500.) While the indicators can flip flop at market turns, this action is rare on the slow monthly indicators. September is the fourth down month in a row.

No comments:

Post a Comment