Baltic Dry Index. 2351 -55

LIR Gold Target by 2019: $3,000.

"But the whole history of America is quite different from Europe. People went there to get away from the intolerance and constraints of life in Europe. They sought liberty and opportunity; and their strong sense of purpose has over two centuries, helped create a new unity and pride in being American."

Margaret Thatcher.

The monthly Coppock Indicators finished June:

DJIA: +269 Down. NASDAQ: +460 Down. SP500: +290 Down.

The bull market (or bear market rally) that commenced on Nasdaq on 30/4/09 at 1717 has ended. (30/5/09 SP 500 at 919, 30/5/09 DJIA 8500.) While the indicators can flip flop at market turns, this action is rare on the slow monthly indicators. Given the weakening BDI, and the ECRI leading indicators signaling recession ahead, it is probably safer to assume that the great stock market bounce has ended and that we are entering a new bear market, or alternately, resuming the old one after a bear market rally.

We open this morning saluting America. America the Great, for all its flaws, still the standard all other countries strive to attain, much of the world tries to emigrate to, legally and illegally. In fact Russia’s latest “spy ring,” on the prosecution’s presented case so far, seems to have given up spying to enjoy a decade of the American high life. As Maggie Thatcher pointed out in the quote above, when America stumbles it doesn’t stay down for long. I suspect that banksterism, casino capitalism, and creeping Swedish-French style 1970s socialism, won’t be around for long. I look forward to the next great American rebound later this decade.

America the Beautiful.

O beautiful for patriot dream

That sees beyond the years

Thine alabaster cities gleam

Undimmed by human tears!

America! America!

God shed his grace on thee

And crown thy good with brotherhood

From sea to shining sea!

http://en.wikipedia.org/wiki/America_the_Beautiful

http://en.wikipedia.org/wiki/Katharine_Lee_Bates

We open though with yet more sign of the double dip recession arriving. The central banks still can’t admit that the great experiment in fiat currency heresy has ended in failure. For the next few years we will likely live through ever more bizarre attempts at propping up the failed fiat friends of the central banksters. My guess is that the “next Lehman” takes out the existing fiat currency system. Unfortunately it will also probably wipe out all the phony, scammy, bogus systems of owning “paper” gold. Stay long physical precious metals, preferably well away from John Bull and Uncle Sam’s larcenous hands.

Below, news that backs up the 40% retreat in the BDI.

"Communist regimes were not some unfortunate aberration, some historical deviation from a socialist ideal. They were the ultimate expression, unconstrained by democratic and electoral pressures, of what socialism is all about.”

Margaret Thatcher.

Fears mount over slowing global demand

By Alan Beattie and James Politi in Washington, Kevin Brown in Singapore and Geoff Dyer in Beijing

Published: July 1 2010 19:14

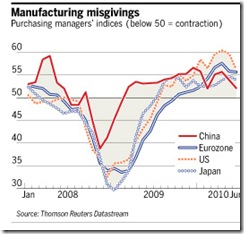

Fears grew that the global recovery is faltering on Thursday after a slew of data pointed to weaker global demand led by slower growth in China.

Figures showed manufacturing output slowing across large parts of the world, posing further challenges to leading economies as they attempt to shore up shaky fiscal positions without falling back into recession.

In Asia – the world’s production powerhouse whose economies are still largely dependent on export demand – manufacturing activity indices for China, South Korea, Taiwan, India and Australia all showed weaker activity for June.

The overall level of factory activity still suggested production was expanding but at a more moderate rate than in recent months.

-----Figures for the US also suggested the economy was losing impetus in spite of being well short of its productive capacity and receiving unprecedented support from monetary and fiscal policy. The Institute for Supply Management’s manufacturing index fell from 59.7 in May to 56.2 in June, a much larger drop than most economists had predicted.

-----Unemployment in the US appears stuck at just below 10 per cent, and hopes that it might start falling received a setback yesterday as new claims for unemployment benefits unexpectedly rose. David Semmens, US economist at Standard Chartered Bank, said the jobless claims figures were “a timely reminder that firings in the US remain elevated and appetite from employers for hirings remains anemic”.

In the eurozone, an update to the manufacturers’ purchasing managers’ index showed its ninth month of expansion, but at a moderate rate that is not using up the spare productive capacity.

-----Nick Beecroft, FX Consultant at Saxo Bank, said: “This looks like the day that fears of a double-dip recession in the US, with all its attendant unpleasant consequences for the US budget deficit, finally trumped eurozone bank and debt concerns.”

http://www.ft.com/cms/s/0/fa81dd7c-8536-11df-9c2f-00144feabdc0.html

Spectre of an economic relapse stalks markets as China wobbles

Fears of an economic relapse across the world have begun to stalk markets again after pending homes sales in the US crashed by a third and a slew of weak data from China and Japan sent bourses tumbling across Asia.

By Ambrose Evans-Pritchard Published: 9:23PM BST 01 Jul 2010

The credit system is once again flashing warnings of extreme fragility, with the yield on 10-year US Treasuries plummeting back to crisis-levels of 2.89pc. Japan's 10-year bond dropped to 1.06pc, the lowest since the country's deflation battle seven years ago. Tokyo's Nikkei stock index tumbled to the lowest level since 2005 as safe-haven flight into the yen surged to levels that leave many Japanese exporters underwater.

"Double-dip is back in the lexicon," said David Bloom, currency chief at HSBC. "Everybody hoped that China's huge fiscal package would keep global growth going long enough for the West to recover, but it does not look like that is happening.

"China is now slowing but the US housing market is falling off a cliff. It's cataclysmic. In Japan the data is turning nasty, and fiscal tightening is just starting in Europe and the UK, so everybody is asking where the growth is going to come from," he said.

Goldman Sachs said its gauge of Global Leading Indicators had peaked. "Signs `under the hood' have pointed to some slowing momentum. Industrial growth is set to decelerate," said the bank.

The US National Association of Realtors said the numbers of home buyers signing contracts dropped 30pc in May from a month ealier, confirming fears that the expiry of subidies would lead to a cliff-edge fall in sales. "Tax credits merely cannibalised sales for the coming months, and did not succeed in jump-starting a lasting recovery of the housing market," said Teunis Brosens from ING.

The US property market is haunted by worries that a cluster of "option ARM" mortgages will reset upwards over the coming months, leading to a fresh wave of defaults.

-----The new twist for investors is the sudden slowdown in China. The HSBC/Markit index of Chinese manufacturing has fallen from a high of 57.4 in January to 50.4 in June, the result of monetary tightening and curbs to cool the red-hot property market.

Wensheng Peng from Barclays Capital said the risk of double-dip is small. "We are seeing a policy-led soft landing, a slowdown that is desired and targeted by the government," he said.

However, analysts are deeply divided on China. A report by the European Chamber in China said there was pervasive over-capacity in steel, cement, chemicals, refining, and energy equipment.

"The Chinese government's massive stimulus package is being pumped into building new plants and adding uneccesary capacity. The problem is getting worse in many industries," it said, claiming that usage rates were as low as 35pc in some sectors.

We end for the day with good news, well good news if you’re an Australian miner or a shareholder in one. Good news too for future mining investment in Australia, which is good news for the rest of us whose 21st century lifestyle relies on access to, and replacement of many of the minerals and metals Australia supplies. Good news too for the London Stock Exchange and the FTSE Index, where many Australian miners are jointly listed. Generally speaking, taxation is bad, merely encouraging feckless populist politicians to fritter the taxes away in bribing the voters to secure their re-election. Any time tax levying politicians anywhere lose big, having their head handed back to them on a platter, even if the fight was lead by some of the biggest mining companies on the planet, it’s a small victory for nearly everyone else on the planet.

“The way to crush the bourgeoisie is to grind them between the millstones of taxation and inflation.”

Vladimir Ilyic Lenin.

Australian PM Gillard strikes a tax deal with the mining giants

Julia Gillard, the Australian prime minister, reached an agreement early on Friday with mining companies on a new tax, striking a compromise to end a simmering dispute that cost her predecessor his job.

By James Hall Published: 12:00AM BST 02 Jul 2010

In order to secure the deal and reach agreement with mining companies, the government has agreed to slash the mining tax rate and cut the types of resources affected. The new resource tax offers concessions to mining companies by taxing iron

ore and coal at a rate of 30pc. The government has also agreed to extend the existing so-called petroleum resource rent tax to coal-seam gas projects which would be taxed at 40pc.

BHP Billiton, one of the biggest companies in the FTSE, said it was encouraged by the deal and described the tax rate as competitive. Shares of all London-listed miners could rise this on the news.

The agreement on the new minerals resources rent tax is due to apply from July 1 2012. It would reduce the government's forward estimate for revenue by A$1.5bn (£836m).

"Socialism's results have ranged between the merely shabby and the truly catastrophic - poverty, strife, oppression and, on the killing fields of communism, the deaths this century of perhaps 100 million people. Against that doctrine was set a contrary, conservative belief in a law-governed liberty. It was this view which triumphed with the crumbling of the Berlin Wall. Since then, the Left has sought rehabilitation by distancing itself from its past."

Margaret Thatcher.

At the Comex silver depositories Thursday, final figures were: Registered 49.86 Moz, Eligible 64.15 Moz, Total 114.01 Moz.

+++++

Crooks and Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

We end for America’s national Independence Day holiday long weekend with the great vampire squids fighting among themselves to the last US taxpayer. Was Ebenezer Squid doing “God’s work” in trying to take out AIG Financial Products division London, home of some of the dumbest risk takers on the planet, or were they taking advantage of AIG’s FP “mastermind” one Joe Cassano, and playing his team of derivatives lunatics for the clueless suckers they proved to be, as they wrote unlimited CDS without making any provision for loss. God must have liked what he saw at the Great Vampire Squid, because it survived thanks to the US taxpayer paying off all the duff AIG CDS at par. How lucky can a great vampire squid get, or what? Who needs a dog in Washington, when you have friends at the Fed and US Treasury?

“If you want a friend in Washington, get a dog”

President Harry S. Truman.

JULY 1, 2010

We Were 'Prudent': AIG Man at Center Of Crisis

Joseph Cassano, who led the division of American International Group Inc. responsible for the mortgage trades that proved the insurer's downfall, on Wednesday staunchly defended his actions, maintaining he made "prudent" decisions and that American taxpayers would have been better off had he stayed on.

In one of the most defiant statements by any Wall Street executive in the thick of the financial crisis, Mr. Cassano told a Congressional panel that he didn't misjudge the risks of subprime mortgage deals his unit entered into when he was its CEO, from 2002 until early 2008.

AIG's problems, he said, were brought on by a liquidity crisis when credit markets seized up— and weren't a result of lax underwriting practices or defaults among mortgage assets his unit had insured. When market values of those assets plunged, the firm was deluged by demands for cash collateral from banks that had bought the insurance from his unit, AIG Financial Products.

"I think I would have negotiated a much better deal for the taxpayer than what the taxpayer got" when the government and AIG in late 2008 paid tens of billions of dollars to banks to cancel the insurance-like contracts AIG wrote on mortgage securities, said Mr. Cassano, speaking publicly for the first time since the giant insurer's near-collapse in the fall of 2008.

Government officials have previously said that billions in payouts to banks were necessary to prevent AIG from filing for bankruptcy. On Wednesday, the Treasury dismissed Mr. Cassano's suggestion that he would have handled the situation better.

"Two years after the financial conflagration began, every amateur firefighter has a theory about how it might have been done differently, but ideas from those who lit the kindling aren't particularly disinterested or useful," a spokesman said.

The near-failure of AIG in 2008 sent shock waves through the global financial system and led to a bailout of up to $182.3 billion by the U.S. government that's nowhere close to being repaid. Because some of the funds were used to settle AIG's contracts with trading partners such as Goldman Sachs Group Inc., the bailout led to accusations that public money was used to rescue investment banks betting on the U.S. housing market.

AIG and Goldman trade blame for crisis

By Justin Baer in Washington Published: July 1 2010 16:03

Goldman Sachs executives responded to allegations that the bank was overly aggressive in seeking collateral from AIG, which was hurtling toward its $180bn government bail-out, noting the insurer had refused to share its valutaions of the debt securities at the heart of the companies’ dispute.

Goldman’s relationship with AIG and its alleged role in the insurer’s spectacular collapse has emerged as a flashpoint for regulators and politicians searching for the causes and the villains of the financial crisis.

In testimony before the Financial Crisis Inquiry Commission, Goldman executives disputed that the bank had consistently marked debt securities insured by AIG at artificially low levels and pressed its counterparty for billions of dollars in collateral.

“AIG continued to dispute our marks, but for almost six months, AIG refused to provide Goldman Sachs with its marks on these same positions,” David Lehman, co-head of Goldman’s structured-products group trading desk, said during testimony before the commission.

Mr Lehman reiterated that Goldman had based its marks on similar transactions in the market. And while AIG had consistently argued that the marks were too low, the insurer was never willing to buy back Goldman’s positions at those lower prices.

“We offered, at various times, to transact with AIG, or other interested market participants that AIG was aware of, at prices consistent with those that we were using to calculate the collateral amounts,” Mr Lehman said. “AIG never took us up on this offer.”

At Thursday’s hearing, AIG’s Andrew Forster dismissed Goldman’s offer as unrealistic given the frozen state of the debt markets at the time.

“Their offer was kind,” Mr Forster quipped, “but not one we were ever going to take up.”

Mr Forster also said AIG had lacked an internal pricing system for much of 2007, and could not provide its own accurate marks until December of that year.

The allegations against Goldman resurfaced during Wednesday’s FCIC hearing, when Joseph Cassano, the former AIG executive who ran the financial-products division that housed its credit default swap portfolio, said his team was stunned by the bank’s collateral calls.

In internal e-mails and in interviews with the commission, AIG executives said they suspected Goldman was intentionally mismarking assets to profit from counterparties’ losses.

http://www.ft.com/cms/s/0/acef9966-8520-11df-9c2f-00144feabdc0.html

"The world urgently needs to create a diversified currency and financial system and fair and just financial order that is not dependent on the United States."

Shi Jianxun. China People’s Daily. September 16, 2008

Another summer weekend, and America takes Monday off to celebrate gaining freedom from the UK’s Hanoverian tyrant, “Mad King George III.” Thankfully it all worked out for the best. Napoleon would have been unlikely to have sold the Louisiana territory to a British North America, similarly Tsarist Russia unlikely to have sold Alaska to it’s great rival in central Asia’s “Great Game.” A class run British North America would have been an unlikely great refuge for Europe’s huddled masses yearning to breathe free. A class run British North American monarchy from Hudson’s Bay to the Gulf of Mexico to San Francisco Bay, would be an unlikely brotherhood from sea to shining sea. Have a great weekend everyone, whether celebrating US Independence day or not. More on the weekend blog.

The New Colossus.

"Keep, ancient lands, your storied pomp!" cries she

With silent lips. "Give me your tired, your poor,

Your huddled masses yearning to breathe free,

The wretched refuse of your teeming shore.

Send these, the homeless, tempest-tossed to me,

I lift my lamp beside the golden door!"

Emma Lazarus, 1883

No comments:

Post a Comment