Baltic Dry Index. 4209 +22

LIR Gold Target by 2019: $3,000

“With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly.”

Dr. Bernanke. November 2005.

While the world awaits news from the Gulf of Mexico on the success or otherwise of BP’s “top kill” attempt to end the spilling oil well disaster in the Gulf, we open the morning with the US pot calling the EU kettle black. US Treasury Secretary Geithner back from eating humble pie in China, rides his high horse across Europe this week, starting in London. Our failed Nixonian experiment with fiat money gets more bizarre by the week. Below the Telegraph on tax challenged Timmy’s European infatuation with Keynesianism. Most European nations are doing the exact opposite as they impose iffy government austerity programs intended one way or another to bailout Europe’s increasingly dodgy banks. Oh what a tangled web we weave when first we practice Goldmanite Greek government accounting. Below Mr. Geithner goes to Berlin.

"the fallout in subprime mortgages is "going to be painful to some lenders, but it is largely contained."

US Treasury Secretary Paulson. March 13th, 2007

MAY 26, 2010

U.S. Chides Europe's Crisis Response

LONDON—U.S. Treasury Secretary Timothy Geithner landed in Europe and reasserted a traditional American role of dispenser of financial advice to the world, telling European governments to get their fiscal houses in order.

After two years in which an historic financial crisis seemed to deprive the U.S. of its self-confident global economic leadership, Mr. Geithner signaled a new-found willingness to reassert American authority on the future of the world economy. "What Europe should do is implement the program they laid out," Mr. Geithner said Wednesday. "The basic lesson of financial crises is that you have to come in and act quickly and with force."

Inside No. 11 Downing Street, the home of his British counterpart, Mr. Geithner pushed continental Europe to speed up the rescue of debt-laden economies, and to not stint on fiscal stimulus. Thursday, in Frankfurt and in Berlin, he will chide the Germans about their recent move to ban certain financial practices, which has spooked markets.

The resumption of U.S. fiscal lecturing marks a turnaround from late 2008, when Asian and Europeans largely blamed the U.S. for dumping the world into a recession.

Mr. Geithner's visit came as the euro fell to $1.22 in New York trading, just above its four-year low, while U.S. stocks tumbled late in the day to close below 10000 for the first time since Feb. 8. New data showed that European banks are increasingly hoarding cash rather than lending, and are borrowing less in short-term lending markets— a sign that investors may be reluctant to do business with banks in countries such as Spain, Portugal and Italy.

Though the U.S. is still burdened with a large deficit, officials argue that its ambitious stimulus program has helped spur growth. Meanwhile, markets and governments are blaming Europe for the renewed tensions in financial markets and the cloud over the nascent global recovery. The deeper Europe's debt problems now grow, the more self-assured U.S policy makers become about what Europe should do next.

----At an economic and strategic summit in China the previous few days, the difference was marked; U.S. confidence remains at low ebb there. Mr. Geithner and other U.S. officials were publicly reticent on the question of revaluing the China's currency, a top priority for some U.S. lawmakers, fearing it could backfire politically.

Mr. Geithner's European tour is reminiscent of the Asian financial crisis of a decade ago when many current Obama economic officials, including Mr. Geithner and White House economic adviser Lawrence Summers, traveled Asia doling out advice and worked behind the scenes at the International Monetary Fund to keep bailout cash flowing. Time magazine dubbed a trio of U.S. officials "the Committee to Save the World."

Mr. Geithner traveled from London to Frankfurt Wednesday, for a working dinner with European Central Bank President Jean-Claude Trichet. On Thursday morning Mr. Geithner is scheduled to meet with President of the German Bundesbank Axel Weber before travelling to Berlin for talks with German Finance Minister, Wolfgang Schäuble.

------ An even larger program for other troubled European nations—as much as $1 trillion—hasn't eased market concerns. Part of the reason, Mr. Geithner believes, is that European nations haven't spelled out the details of how the procedure would work.

The U.S. believes that without the heavy involvement of President Obama and Mr. Geithner, Europe wouldn't have been willing to put together the size of bailout package that would impress markets that government had a handle on the problem.

The U.S. is also advising European countries that can afford it—the U.K., Germany, France—to keep pumping stimulus into their economies. That would help ensure the European economy can continue to expand while economically troubled countries like Spain and Greece make wrenching cutbacks to reduce out-of-control deficits.

http://online.wsj.com/article/SB10001424052748704717004575268284276354448.html?mod=WSJEUROPE_hps_MIDDLETopStories

Clearly preoccupied by keeping China buying US debt and watching the slow motion BP oil disaster in the Gulf of Diesel, Mr. Geithner hasn’t noticed that the UK is firmly in the deficit camp of deadbeat Spain and Greece. Pumping stimulus into the UK economy wasn’t an option even in our Alice in Wonderland former Nu Labour pre election economy. It would be interesting to hear the great man’s thoughts too, on where France is supposed to come up with extra cash for stimulus. Nor, I suspect, will the great man’s socialist largess with Germany’s taxpayer money be much in tune with the mood in Berlin. The Greek way of life is completely expendable to Hans, Fritz and Brunehilde. I wonder what they smoke in Club Obama?

"I don't see (subprime mortgage market troubles) imposing a serious problem. I think it's going to be largely contained." "All the signs I look at" show "the housing market is at or near the bottom,"

US Treasury Secretary Paulson. April 20th, 2007

Germany Tries to Plug Gaping Hole in Its Budget

By Ralf Beste, Christian Reiermann and Merlind Theile 05/26/2010

The task of putting together next year's budget is presenting German Chancellor Angela Merkel with a huge challenge. The government urgently needs to cut costs in order to comply with the country's new debt ceiling rule and to help stabilize the euro. The chancellor wants to set an example for Europe on how best to cut costs.

It was the afternoon of Sunday, May 16 when Germany's coalition government of the center-right Christian Democrats (CDU/CSU) and the liberal Free Democratic Party (FDP) finally got down to the business of governing -- six months after taking office. In her office on the eighth floor of the Chancellery in Berlin, Chancellor Angela Merkel met with Finance Minister Wolfgang Schäuble, who had just been released from the hospital.

The chancellor briefly asked about the health of her finance minister, who for several weeks had only been able to perform his official duties with difficulty. After being plagued with a surgical wound that refused to heal properly, Schäuble had to be readmitted to the hospital when he had an adverse reaction to a medication.

The two politicians eventually turned to a similarly urgent case, Germany's national budget, which is currently faring almost as poorly as the minister who is in charge of it. By the end of June, Merkel and her finance chief will not only be called upon to assemble an austerity package, but will also have to restructure the government's finances from the ground up.

It's an enormous challenge. The German government faces an ongoing gap of €75 billion ($93 billion) between what it takes in and its expenditures, something that economists refer to as a structural deficit. Contrary to previous assumptions, this deficit has risen by another €5 billion because projected tax revenues have turned out to be lower than expected, as the most recent forecast by the relevant experts showed. The need to cut costs is growing, partly as a result of the new "debt brake" or debt ceiling provision that has been incorporated into Germany's constitution, which will require Merkel and Schäuble to reduce the government's budget by an additional €10 billion a year between now and 2016.

http://www.spiegel.de/international/germany/0,1518,696760,00.html#ref=nlint

In other European news its high noon time for Spain. Mr. Geithner and his horse won’t be visiting Madrid. Below, Spain’s minority socialist government has a Damascene conversion and attempts some overdue Thatcherite reform. Below that, another Spanish bank gets near the wall. Below that, PIMCO’s Mr. Gross states the obvious. But will the restructuring come before more riots and strikes turn Greece into an unsolvable basket case?

'The worst is likely to be behind us"

US Treasury Secretary Paulson. May 7, 2008

Zapatero Bets Future on Austerity as Political Support Wavers

May 27 (Bloomberg) -- Spain’s deepest budget cuts in 30 years may be just the start of a U-turn by Prime Minister Jose Luis Rodriguez Zapatero that’s already sent his popularity plunging and prompted calls for a general strike.

As parliament debates the first wave of cuts today, his minority administration is preparing the ground for further measures that his traditional Socialist allies may oppose. After cutting civil servants’ salaries by 5 percent, the government now plans to rein back some of the best worker protection in Europe and raise the retirement age.

Zapatero’s latest steps to reduce the euro region’s third- biggest deficit won applause from the International Monetary Fund as the government tries to reassure investors that Spain can avoid the same fate as Greece. With smaller parties still refusing to guarantee support for those measures in today’s vote, the risk for Zapatero is that he’ll struggle to push through further cuts.

-----At least three Socialist lawmakers refused to join the rest of the party in a standing ovation when Zapatero first announced the cuts on May 12 and the opposition, pro-business People’s Party says it will vote against them today. With 169 seats in Spain’s 350-member assembly, Zapatero’s Socialists are seven short of a majority and pass legislation on a vote-by-vote basis.

The debate starts at 9 a.m. local time and a vote will be held later today. As four parliamentary groups plan to vote against the measures, Zapatero is depending on the abstention of 10 lawmakers from the Catalan Convergencia i Unio party. A spokeswoman said late yesterday they would probably do so though no decision has been taken yet.

Even if the measures are approved, Zapatero will still have to patch a coalition together to get the 2011 budget through parliament.

----Zapatero’s policies mark a turnaround for a prime minister who has raised pensions, courted unions, and created subsidies for new mothers since coming to power in 2004.

Finance Minister Elena Salgado said as recently as February that Spain wouldn’t cut wages for government workers. A public sector strike is planned for June 8 and the largest union, Comisiones Obreras, has said a general strike is getting closer.

http://www.bloomberg.com/apps/news?pid=20601085&sid=azgZJAxLv9sw

BBVA Pares Gains on Report It Can’t Renew Funding

May 26 (Bloomberg) -- Banco Bilbao Vizcaya Argentaria SA, Spain’s second-biggest bank, pared gains after the Wall Street Journal reported the lender was unable to renew about $1 billion of short-term funding.

----The Bilbao, Spain-based lender hasn’t been able to renew the funding in the U.S. commercial paper market this month, according to the newspaper. The bank still has substantial European-based funding and deposits and about $9 billion in U.S. commercial paper, the newspaper said today.

Spanish bank shares have plunged this year on concern over the government’s ability to restore economic growth after the worst recession in 60 years and bring down a budget deficit that the government expects will be 9.3 percent of gross domestic product this year. Shares in BBVA, which last month reported first-quarter profit of 1.2 billion euros ($1.5 billion) as its bad loans stabilized, have dropped 36 percent this year, valuing the lender at 31 billion euros.

http://www.bloomberg.com/apps/news?pid=email_en&sid=a_05F28lJ8D8

Greece Debt Restructuring Is Inevitable, Gross Says

May 26 (Bloomberg) -- Pacific Investment Management Co.’s Bill Gross said restrictive lending rates and austerity measures that slow growth will leave Greece with “no way out” of a debt restructuring.

“The growth required in order to shoulder Greece’s debt burden is so excessive and the fiscal restrictiveness being imposed on the country is so restrictive they there will be no way out,” Gross said, in an interview with Bloomberg Television. “Restructuring at some point down the road -- perhaps a year or two years down the road -- will take place.”

Pressured by a sliding euro and soaring bond yields, European leaders agreed this month to an unprecedented loan package worth almost $1 trillion to keep the sovereign-debt crisis that originated in Greece from spreading. Greece pledged to implement austerity measures equal to almost 14 percent of gross domestic product in exchange for rescue funds from the European Union.

The average euro-area budget gap will widen to 6.6 percent of gross domestic product this year from 6.3 percent in 2009, the European Commission forecasts. The Maastricht Treaty stipulates that EU states should keep their budget deficits within 3 percent of GDP.

“At the now-restrictive yields of Libor plus 300-350 basis points being imposed by the EU and the IMF alike, there is no reasonable scenario which would allow Greece to ‘grow’ its way out,” Gross wrote in his June investment outlook today on the Newport Beach, California-based company’s website.

http://www.bloomberg.com/apps/news?pid=20602007&sid=aZAUNeSuGf48

Next, a US lawsuit that threatens to turn a spotlight on Wall Street’s rapacious practices during the great Lehman crash of 2008, and on JP Morgan in particular. When great vampire squids fall out, the resulting discovery is going to prove very informative for the rest of us. The regulators and Attorney Generals will watch this case like hawks. Do Lehman’s whiplash Willies, have access to a JPM whistleblower? Time will tell, but I suspect that in the months ahead, JPM will join the Goldmanites in Wall Street’s reviled sin bin. Whatever next? AIG sues Goldman? Bear Stearns ex-shareholders sue JPM?

"it's a safe banking system, a sound banking system. Our regulators are on top of it. This is a very manageable situation."

US Treasury Secretary Paulson. July 20th, 2008

Lehman Sues JPMorgan for Billions of Dollars in ‘Lost Value’

May 27 (Bloomberg) -- Lehman Brothers Holdings Inc. sued JPMorgan Chase & Co. to recover tens of billions of dollars in “lost value,” accusing the bank of precipitating its downfall and preventing it from winding down in an orderly fashion.

JPMorgan, which was Lehman’s main short-term lender before its September 2008 bankruptcy, helped cause the failure by demanding $8.6 billion of collateral as credit markets tightened during the financial crisis, Lehman said in a complaint filed yesterday in U.S. Bankruptcy Court in New York.

“On the brink of LBHI’s bankruptcy, JPMorgan leveraged its life and death power as the brokerage firm’s primary clearing bank to force LBHI into a series of one-sided agreements and to siphon billions of dollars in critically needed assets,” Lehman said in the complaint.

Lehman, once the fourth-biggest investment bank, has said it may spend another five years selling assets to pay unsecured creditors as little as 14.7 cents on the dollar. Any money recovered through lawsuits may increase the payout.

“The lawsuit is ill conceived, and the costly litigation will cause a further drain on the limited resources available to the Lehman bankruptcy estate,” said Joe Evangelisti, a JPMorgan spokesman.

The lawsuit follows a report by Lehman examiner Anton Valukas, who said in March that Lehman might have grounds for suing JPMorgan and other banks.

Lehman said JPMorgan’s top managers took advantage of privileged information they gained as Lehman’s primary clearing bank to “capitalize” on a Lehman bankruptcy.

http://www.bloomberg.com/apps/news?pid=20601103&sid=a0cYmuEK7P_o

We close with rising trouble in China’s bubble. The workers want a better deal. Below, Honda gets shutdown by industrial action. In parts of China like the Pearl River delta, China now has a labour shortage which strengthens the hand of the workers. Depending how long the shutdown lasts, Honda can probably make up the lost production, but I suspect that the easy profits manufacturing phase of China’s great modernization has come to its end. Foreign manufacturers will increasingly find profits squeezed.

Honda shares slip; China production said halted

TOKYO (MarketWatch) -- Japanese car maker Honda Motor Co. stopped production at all four of its Chinese auto plants after workers at a parts factory went on strike, seeking higher wages, according to published reports Thursday. Honda closed two plants in Guangzhou, Guangdong province on May 24 and plants in Guangzhou and Wuhan, Hubei province, on May 26, after workers making transmissions and engine parts at Honda Auto Parts Manufacturing Co. in Foshan, Guangdong province, went on strike May 17, Bloomberg News reported. In Tokyo, Honda shares were down 0.8%, while the Nikkei Stock Average was down 0.6%.

http://www.marketwatch.com/story/honda-shares-slip-china-production-said-halted-2010-05-26

“Our forecast is for moderate but positive growth going into next year. We think that by the spring, early next year, that as these credit problems resolve and, as we hope, the housing market begins to find a bottom, that the broader resiliency of the economy, which we are seeing in other areas outside of housing, will take control and will help the economy recover to a more reasonable growth pace.”

Ben Bernanke. November 8, 2007

At the Comex silver depositories Wednesday, final figures were: Registered 52.60 Moz, Eligible 64.82 Moz, Total 117.42 Moz.

Day 18 of Hitler’s attack in the west that almost brought down western civilization. Dunkirk evacuation day 1.

Dunkirk & the Battle of France – Day by day 70 years on.

http://londonirvinereport.blogspot.com/p/dunkirk-battle-of-france.html

+++++

Crooks & Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

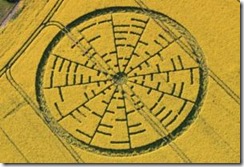

Today, a crop circle article that I suspect turns tongue in cheek. Could anyone seriously be dumb enough to believe the explanation.

"'Speak English!' said the Eaglet. 'I don't know the meaning of half those long words, and I don't believe you do either!'"

Alice in Wonderland.

Crop circle season arrives with a mathematical message

By Matilda Battersby Wednesday, 26 May 2010

It is perhaps little known that the beautiful county of Wiltshire, famed for Stonehenge and the white horses carved into its hills, is the most active area for crop circles in the world, with nearly 70 appearing in its fields in 2009.

It is unsurprising then, that the appearance of a phenomenally complex 300ft design carved into an expanse of rape seed on a Wiltshire hillside has caused excitement. But it's not just the eye-pleasing shape which has drawn attention to it. The intersected concentric pattern has been decoded by experts as a “tantalising approximation” of a mathematical formula called Euler’s Identity (e ^ ( i * Pi ) + 1 = 0), widely thought be the most beautiful and profound mathematical equation in the world.

The design (pictured above) appeared beside Wilton Windmill late on Friday night. Lucy Pringle, a founder of the Centre for Crop Circle Studies, was one of the first on the scene. She says: “What has happened in this particular crop circle is that there are 12 segments and within each segment there are 8 partly concentric rings. Each of these segments indicates a binary code based on 0 and 1. If you use an Ascii Table [computer calculation system], the pattern transposes itself into a tantalising approximation of Euler’s equation.”

The average person finds such complex mathematical talk utterly confounding, so The Independent Online asked Dr John Talbot, a maths research fellow at University College London, for his take on the matter. He said: “Looking at the crop circle, the link with Euler’s most famous theory seems to make perfect sense. However, the way the formula has been executed is partially incorrect. One of the discrepancies is that one part of the formula translates as ‘hi’ rather than ‘i’, which could be somebody’s idea of a joke.”

The Wilton Windmill circle is not the first to have provoked mathematical exposition. In July 2008 a photograph of a crop circle near Barbary Castle (also in Wiltshire) caught the attention of retired American astrophysicist Mike Reed when he saw it in a national newspaper. He was struck by its shape and eventually concluded that it was a coded image representing the first ten digits of Pi (3.141592654), a conclusion declared to be a “seminal event” by Pringle at the time.

Sceptics dismiss crop circles as utter rubbish, but despite decades of research nobody knows conclusively how they’re made. As Francine Blake of the Wiltshire Crop Circle Study Group, explains: “The difficulty is that we don’t know the answer. It’s something that needs to be treated with great respect, but is too often talked about flippantly in the media which, I think, closes the subject rather than opens it.”

There has been extensive scientific exploration into the affect the circles have on nearby wildlife. Flowers and soils inside crop circles are dramatically altered, Blake explains. Pringle observed in a 2003 experiment that seed samples taken from inside a crop circle had 40 per cent higher protein levels than those taken from outside it.

Another interesting element is the nature of the soil on which the circles appear. Pringle says that 93.8 per cent of crop circles are made on chalk, "a worldwide phenomenon" recorded in 54 different countries. She says the significance may be connected to underground springs called aquifers commonly found in chalk: "It is thought that the originating force probably originates in the ionosphere (an area of atmospheric electricity). The force then spirals to earth in the form of a vortical plasma and hits the ground with some 100 of 1000's of volts per metre for just a nano second only, else the crop would be burnt. Occasionally we do see evidence of scorched flattened crop inside certain circles. The electromagnetic fields of both the underground springs and the descending force work in harmony or conjunction with each other."

Blake also remarks on the significance of the chalk, which she says the ancients often built their monuments on - an observation which the existence of Neolithic sites like Stonehenge and Avebury attest. She says the ancients also built their temples on “energy lines” and has observed that “crop circles always appear on or near these lines.” Blake was impressed with the Barbary Castle circle and its derivations because the shape itself was “like a Labyrinth,” which “gives it a spiritual as well as a mathematical tradition.”

Nobody knows for sure how crop circles are made. Reports of strange mists creating the complicated patterns in a matter of minutes, their connotations with little green men and Midwich Cuckoos and elaborate hoaxes have fostered a widespread unwillingness to take the idea seriously. This approach both feeds the mystery around the concept and prevents further exploration of it, as it is an area of research that is unlikely to be awarded large research grants or space on university courses. But, as Blake remarks: “There’s neither rhyme nor reason, they just keep coming.” And with crops nearly at their full height, the UK’s crop circle season is upon us. If you want to see for yourself Wiltshire is your best bet.

"I don't believe there's an atom of meaning in it."

Lewis Carroll. Alice in Wonderland.

The monthly Coppock Indicators finished April:

DJIA: +245 UP. NASDAQ: +448 UP. SP500: +276 UP. The great Bull market goes on with the all three continuing higher in positive numbers. But how much Bull is enough?

Help the LIR fight Banksterism, the EU, and for sound money.

If you can, help the LIR stay around and make a difference. Please make a donation at the PayPal link on the website or better still become a sponsor for what looks like an exciting 2010. Capitalism not banksterism. Many thanks to all who have helped.

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of $250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of $250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.