Baltic Dry Index. 1371 +36

LIR Gold Target by 2019: $30,000. Revised due to QE.

"To combat depression by a forced credit expansion is to attempt to cure the evil by the very means which brought it about; because we are suffering from a misdirection or production, we want to create further misdirection- a procedure which can only lead to a much more severe crisis as soon as the credit expansion comes to an end."

Friedrich Hayek, 1933

While Dr. Bernanke conditions the Congress and American people for QE3 and more inflation, on the left side of the Atlantic, ECB President Trichet was out strutting his Germanic side and conditioning Euroland governments for a coming interest rate hike. If it happens, Club Med’s members will likely start drowning again requiring a rescue fast. So much for G-20 cooperation and joined up policies. But first this.

"The Capitalists will sell us the rope with which we will hang them."

Vladimir Ilyic Lenin.

Did China or Jihadists try to bankrupt America? Pentagon report reveals financial terrorists may have triggered economic crash

Two mystery investors 'were number one traders in all financial companies that collapsed or are now financially supported by the U.S. government'

Last updated at 3:48 PM on 2nd March 2011

Terrorists and other 'financial enemies' were likely responsible for the near collapse of the U.S. financial system in 2008, a new Pentagon report has concluded.

The 2009 report, Economic Warfare: Risks and Responses, said financial terrorism by Jihadists or countries such as China may have cost the global economy $50 trillion in a series of co-ordinated strikes against the U.S. economy.

In an astonishing conclusion, the report claims two unidentified traders deliberately devalued trillions of dollars' worth of stocks at the height of the crisis.

Below, The Telegraph on the Frankfurt Follies.

"We shouldn't pour cold water on everything. We, the eight or nine players in global investment banking, have a very good future."

Deutsche Bank, CEO Josef Ackermann. Davos, January 2007.

ECB prepares rate rise as global tide turns

The European Central Bank has surprised markets by signalling a rate rise as soon as next month, brushing aside warnings that this may compound damage from the oil shock and push EMU debtor states deeper into crisis

By Ambrose Evans-Pritchard, International Business Editor 6:00AM GMT 04 Mar 2011

"We are in a posture of strong vigilance: an increase in interest rates at the next meeting is possible," said ECB president Jean-Claude Trichet, following a meeting of the governing council. The code word "vigilance" sent the euro rocketing to almost $1.40 against the dollar.

The ECB is the first of the big central banks to signal a rate rise to curb inflation, marking a major turning point in the global policy cycle.

"This is a shock," said Silvio Peruzzo from RBS. "This raises risks for the eurozone periphery through all kinds of channels. Most mortgages in Spain are on floating rates."

Santiago Carbó from Granada University said the shift was "very worrying" for Spain. "It catches us at a bad time: we haven't finished cleaning up the financial system."

Mr Trichet said the ECB aims to stop inflation psychology gaining a foothold, though he played down fears of a "series" of rate rises. As a concession, the ECB once again extended its unlimited 3-month liquidity for "addicted" Irish, Greek, and Iberian banks.

The ECB is starkly at odds with the Federal Reserve on the impact of surging oil and food prices. Fed chair Ben Bernanke said this week that inflation spill-over is likely to be "temporary and relatively modest". The Fed view is that commodity shocks drain demand in the wider economy, acting as a deflationary tax.

The ECB's task is hugely complicated by the widening North-South split and incipient wage inflation in Germany. Jörg Krämer from Commerzbank said the ECB's 1pc rate is "far too low" for booming Germany".

Dr Krämer thinks that the ECB is tilting monetary policy to help Club Med and Ireland, a view widely held in Germany and reinforced by the resignation of Bundesbank chief Axel Weber following his refusal to back ECB rescue policies.

German loss of control over EMU's monetary machinery is a neuralgic issue, threatening a unwritten contract with the German people that the euro would be as hard as the old D-Mark. Hawkish moves by the ECB at this stage may be intended to keep German opinion on board and head off an EMU political crisis.

More

Of course both Bernanke and Trichet could be bluffing, with neither intending to actually follow through with their hinted policy, but what would be the gain in that? Each would quickly lose the little credibility that they have left, at a cost of a weakening dollar and strengthening Euro. The European Monetary Union would take a giant leap closer to flying apart, while China would rightly feel betrayed by US authorities. Stay long gold and silver. I expect both to follow through. Once on QE it’s impossible to stop without triggering the economic collapse it was started to prevent. QE ad infinitum. In Germanic Euroland, an interest rate set for Ireland and Club Med, is now way to low for the Germanic industrial core. Club Med is expendable when push comes to shove. Besides, with Italy’s fate tied to that of Gaddafi, Club Med may be a goner no matter what else happens. Is the death of fat currency fun, or what?

In other EU news, will little Ireland’s government stand up for Ireland’s serfs aka voters, at today’s Helsinki summit? The new government should pull a De Gaulle and repudiate the previous government’s agreement and threaten a default if the EU won’t renegotiate. That way, the EMU governments get to bailout their bankrupt banks directly, rather than bailout their banks by crushing the Irish population. My guess is that the EU will bully the Irish into submission.

Since love and fear can hardly coexist together, if we must choose between them, it is far safer to be feared than loved.

Niccolo Machiavelli.

Merkel Risks Clash Over Irish Bailout in Euro Rescue Push

By Tony Czuczka and Kati Pohjanpalo - Mar 3, 2011

German Chancellor Angela Merkel is resisting calls to ease Ireland’s bailout terms as she prepares to meet with European allies, underscoring the gulf on crisis- fighting steps that persists even among members of the same political family.

Merkel and incoming Irish Prime Minister Enda Kenny, who was elected on a platform of renegotiating the bailout, Polish Prime Minister Donald Tusk and European Union President Herman Van Rompuy are among those due to attend a meeting of European People’s Party leaders in Helsinki today. Their host is Finnish Finance Minister Jyrki Katainen, who has signaled he opposes lowering Ireland’s average loan rate of 5.8 percent.

“You can’t be rewarded by others for doing your job well,” Katainen said yesterday in an interview, saying that indebted countries shouldn’t expect concessions if they agree to further measures to boost their competitiveness and stabilize their finances. “The concession is that those countries’ credibility in the markets will improve.”

As the EU’s end-of-the-month deadline for a reinforced plan to aid debt-strapped countries looms, German officials are showing more reluctance to forge a grand bargain to protect the euro. The European Central Bank’s hints of rate increases as soon as April add yet more urgency to fix the finances of peripheral euro states.

More.

In commodities news, the situation in the world’s biggest cocoa exporter goes from bad to worse. A shortage of cocoa comes next.

Ivory Coast on brink of civil war as seven women killed at protest march

Military says shootings were 'blunder we regret' as once stable nation faces meltdown

Thursday 3 March 2011 20.35 GMT

Seven women have been massacred during a peaceful protest in Ivory Coast as the country appeared to stand on the brink of all-out civil war.

More than 200,000 people have fled, and the nation that was once a model of stability in west Africa is now experiencing bloodshed and economic meltdown.

The women's demonstration became a scene of terror when security forces opened fire with machine guns in Abobo, a sprawling, impoverished suburb of the commercial capital, Abidjan, where some of the deadliest clashes have taken place during three months of crisis.

They were about to set off from a roundabout on a march to call on Laurent Gbagbo to step down as president. "Men in uniform drove up and started shooting randomly. Six women died on the spot," Idrissa Diarrassouba told Reuters. A seventh died in hospital. Many others were wounded.

There was no official comment but a military source confirmed the shooting. "It was a blunder that we regret," the source said, adding that security forces believe rebels sometimes hide among civilians. "It is unfortunate."

The UN says at least 365 people have died since November's election, nearly all supporters of Alassane Ouattara, the internationally recognised winner. The UN said, just after the shooting, that more than 26 people were killed in the past 24 hours in Abobo, where most people come from the country's north.

Multiple delegations of African leaders have come through Abidjan, but Gbagbo has rejected offers of amnesty and comfortable exile abroad if he leaves office.

The UN, other organisations and analysts warn that the country could return to civil war, as in 2002-3, which divided north and south. The International Crisis Group says war is imminent, with skirmishes in Abidjan and the west of the country between militias and army loyal to Gbagbo and the former insurgent New Forces, backing Outtara.

More.

http://www.guardian.co.uk/world/2011/mar/03/ivory-coast-women-killed

We end for the day with Der Spiegel and the voice of reason from the past. If only our politicians listened to anyone but banksters.

Success is the ability to go from one failure to another with no loss of enthusiasm.

Winston Spencer Churchill.

Last of the July 20 Plotters 02/28/2011

'There Will Be Another Hitler Some Day'

Ewald von Kleist, 88, a former officer in the German Wehrmacht and the last surviving member of the July 20, 1944 plot against Hitler, discusses Germany's elimination of conscription, why German soldiers need to toughen up and his failed attempt to kill Adolf Hitler.

----SPIEGEL: Do you believe that Germany's freedom is being defended in Afghanistan, as former German Defense Minister Peter Struck famously said once?

Kleist: You are intelligent enough (to know the answer to that).

SPIEGEL: You don't believe it, do you?

Kleist: No, I really don't. I've never heard about our having protectorates there or about large numbers of Germans vacationing in the country.

SPIEGEL: The 9/11 attacks triggered Article 5 of the North Atlantic Treaty, which states that NATO members are required to assist other members if they come under attack. According to this logic, the Bundeswehr was obligated to support the United States in its war against Islamist terrorism and in Afghanistan, in particular, because that is where the people behind the attacks were.

Kleist: It's true that, after Sept. 11, 2001, the United States declared war on global terrorism. But against which country? Why is this a war? And who is the enemy?

SPIEGEL: The enemy is the Taliban in Afghanistan and the al-Qaida terror network.

Kleist: Al-Qaida is a chimera. There's no organization, and there's no country you can wage a war against. Instead, we're waging war against an idea. At the time, we should have asked whether this actually was a war within the meaning of Article 5 of the NATO treaty.

----SPIEGEL: The Bundeswehr is defending universal values -- that is, human rights -- in Afghanistan. Isn't that an honorable goal?

Kleist: The real question is whether it's right for our people to have to die so that girls can go to school in Asia. The answer to that doesn't seem very clear to me.

SPIEGEL: So, what is worth dying for?

Kleist: Risking the lives of German soldiers is only justified when our vital interests are threatened. Exactly what those vital interests are has to be decided on a case-by-case basis. Then, we have to determine whether we have the means to achieve our goals. And, finally, I have to ask myself how I can get back out. A military mission is only justified when we have a convincing answer to these questions.

SPIEGEL: Looking back at the Bundeswehr's military missions over the last 20 years, has any of them met your criteria?

Kleist: My memory is no longer what it used to be. I can't think of anything at the moment that I was very enthusiastic about. Let's take Somalia, for example. The Bundeswehr was sent there to build bridges and roads. That sort of stuff is really just silly.

-----SPIEGEL: Who would wage such a war? The United States and Russia are making mutual efforts at disarmament. US President Barack Obama has even announced a goal he calls "Global Zero," or the elimination of all nuclear weapons across the entire world.

Kleist: Obama's idea of a world without nuclear weapons is nonsense. No one who can count to five believes it can happen. But the nuclear weapons of Russia and the United States are not the problem.

SPIEGEL: Then which weapons are?

Kleist: The fact that we're sitting here having this conversation is because, in the past, the major nuclear powers -- namely, America and Russia -- thought the same way about life and death. Both said that life is good and that death should be prevented. But not all countries feel this way anymore.

SPIEGEL: To whom exactly are you referring?

Kleist: We can all recall the images of Iranian children with green headbands running straight into Iraqi machine-gun fire. Their parents allowed this to happen because they believed their children were fulfilling the will of Allah.

SPIEGEL: At the time, nuclear weapons weren't as much of an issue as they are now.

Kleist: No, but the change in the attitude toward life and death reveals a very important issue. Some time ago, (al-Qaida leader Osama) bin Laden said: "The difference between us is that you love life and we love death." I'm afraid he's right.

SPIEGEL: Countries generally act more rationally than terrorist organizations.

Kleist: One of the last things Hitler said was: "We will slam the door shut behind us with a loud bang." He wasn't able to do it at the time, but who can say whether an Iranian leader won't feel the same way some day? Or look at Pakistan: What happens if there is regime change and the Islamists get their hands on nuclear bombs? There will be another Hitler some day.

More

http://www.spiegel.de/international/germany/0,1518,748844-2,00.html

The market, like the Lord, helps those who help themselves. But, unlike the Lord, the market does not forgive those who know not what they do.

Warren Buffett.

At the Comex silver depositories Thursday, final figures were: Registered 43.12 Moz, Eligible 60.40 Moz, Total 103.52 Moz.

+++++

Crooks and Scoundrels Corner.

The bent, the seriously bent, and the totally doubled over.

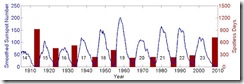

No crooks today, just the latest of the missing sunspots during the minimum that just ended. Note, I think that there is a correlation between elevated prolonged minimums and spring summer droughts in North America. We shall see if 2010-2012 become like the dust bowl 30s, or 1910-1912. I don’t have enough data on the USSR crop production in the 30s to really know if a drought was behind Stalin’s theft of the Ukraine’s wheat in 1933 causing a man made famine. His collectivization program in Russia producing disastrous results might have been the cause, but last year the old USSR grain regions underwent drought. The world has big problem’s if the region gets back to back droughts.

Researchers Crack the Mystery of the Missing Sunspots

March 2, 2011: In 2008-2009, sunspots almost completely disappeared for two years. Solar activity dropped to hundred-year lows; Earth's upper atmosphere cooled and collapsed; the sun’s magnetic field weakened, allowing cosmic rays to penetrate the Solar System in record numbers. It was a big event, and solar physicists openly wondered, where have all the sunspots gone?

Now they know. An answer is being published in the March 3rd edition of Nature.

Plasma currents deep inside the sun interfered with the formation of sunspots and prolonged solar minimum," says lead author Dibyendu Nandi of the Indian Institute of Science Education and Research in Kolkata. "Our conclusions are based on a new computer model of the sun's interior."

For years, solar physicists have recognized the importance of the sun's "Great Conveyor Belt." A vast system of plasma currents called ‘meridional flows’ (akin to ocean currents on Earth) travel along the sun's surface, plunge inward around the poles, and pop up again near the sun's equator. These looping currents play a key role in the 11-year solar cycle. When sunspots begin to decay, surface currents sweep up their magnetic remains and pull them down inside the star; 300,000 km below the surface, the sun’s magnetic dynamo amplifies the decaying magnetic fields. Re-animated sunspots become buoyant and bob up to the surface like a cork in water—voila! A new solar cycle is born.

For the first time, Nandi’s team believes they have developed a computer model that gets the physics right for all three aspects of this process--the magnetic dynamo, the conveyor belt, and the buoyant evolution of sunspot magnetic fields.

"According to our model, the trouble with sunspots actually began in back in the late 1990s during the upswing of Solar Cycle 23," says co-author Andrés Muñoz-Jaramillo of the Harvard-Smithsonian Center for Astrophysics. "At that time, the conveyor belt sped up."

The fast-moving belt rapidly dragged sunspot corpses down to sun's inner dynamo for amplification. At first glance, this might seem to boost sunspot production, but no. When the remains of old sunspots reached the dynamo, they rode the belt through the amplification zone too hastily for full re-animation. Sunspot production was stunted

Later, in the 2000s, according to the model, the Conveyor Belt slowed down again, allowing magnetic fields to spend more time in the amplification zone, but the damage was already done. New sunspots were in short supply. Adding insult to injury, the slow moving belt did little to assist re-animated sunspots on their journey back to the surface, delaying the onset of Solar Cycle 24.

"The stage was set for the deepest solar minimum in a century," says co-author Petrus Martens of the Montana State University Department of Physics.

Colleagues and supporters of the team are calling the new model a significant advance.

"Understanding and predicting solar minimum is something we’ve never been able to do before---and it turns out to be very important," says Lika Guhathakurta of NASA’s Heliophysics Division in Washington, DC.

While Solar Max is relatively brief, lasting a few years punctuated by episodes of violent flaring, over and done in days, Solar Minimum can grind on for many years. The famous Maunder Minimum of the 17th century lasted 70 years and coincided with the deepest part of Europe's Little Ice Age. Researchers are still struggling to understand the connection.

One thing is clear: During long minima, strange things happen. In 2008-2009, the sun’s global magnetic field weakened and the solar wind subsided. Cosmic rays normally held at bay by the sun’s windy magnetism surged into the inner solar system. During the deepest solar minimum in a century, ironically, space became a more dangerous place to travel. At the same time, the heating action of UV rays normally provided by sunspots was absent, so Earth’s upper atmosphere began to cool and collapse. Space junk stopped decaying as rapidly as usual and started accumulating in Earth orbit. And so on….

Nandi notes that their new computer model explained not only the absence of sunspots but also the sun’s weakened magnetic field in 08-09. "It's confirmation that we’re on the right track."

http://science.nasa.gov/science-news/science-at-nasa/2011/02mar_spotlesssun/

"…it is very likely that April 2008 will mark the bottom of the U.S. housing market. Yes, the housing market is bottoming right now."

Cyril Moulle-Berteaux. Managing partner, Traxis Partners LP. May 6, 2008. WSJ.

Another weekend and on Saturday I’m off to Toronto for the Producers and Developers Association of Canada, international trade show and convention. These are the metals producers and prospectors of everything from familiar copper, to exotic rare earth elements. I can’t stay too long due to my mother’s hospitalization, the other family members will be covering while I’ away, but due to travel and meetings, and hopefully some cavorting, there won’t be a usual weekend blog update, nor an email LIR from next Monday until Thursday the 10th. Have a great weekend everyone.

The monthly Coppock Indicators finished February:

DJIA: +156 Down 05. NASDAQ: +217 Down 11. SP500: +157 Down 4.

No comments:

Post a Comment